If you accept payments through platforms like PayPal, Venmo, Cash App, eBay, Etsy, Amazon, or ticket and rideshare apps, the Form 1099-K rules matter to you. For tax year 2025, the federal reporting threshold is dropping again, and more sellers will see a 1099-K in their mailbox or inbox than ever before.

This guide from Nguyen & Associates, CPA explains what changed for 2025, who is affected, how state rules fit in, and the practical steps you should take before you file.

1. 2025 Form 1099-K Rules at a Glance

Form 1099-K reports payments for goods and services that are processed by payment cards and third party networks. That includes credit and debit cards, online payment apps, and marketplaces that collect money on your behalf and then send payouts to you.

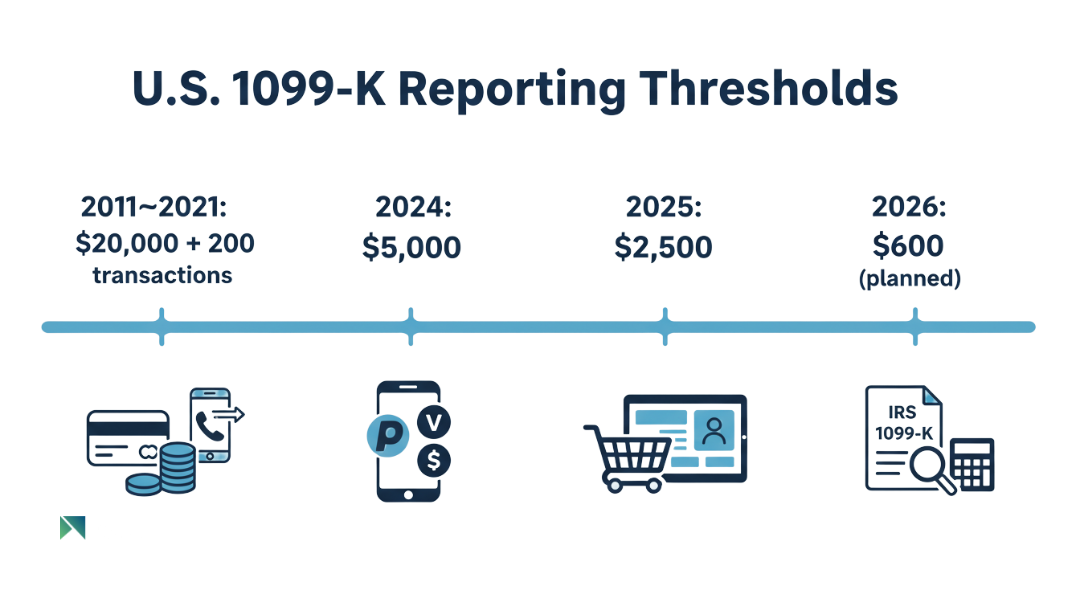

For many years, the federal rule was simple and high: a 1099-K was required only if a seller exceeded $20,000 in gross payments and had more than 200 transactions in a calendar year. The American Rescue Plan Act of 2021 changed that and set a new federal threshold of $600 in aggregate payments, regardless of transaction count.

Because that was such a large drop, the IRS has used transitional thresholds:

- 2011 to 2021: $20,000 and more than 200 transactions.

- 2024: Transitional $5,000 threshold.

- 2025: Transitional $2,500 threshold, with no transaction count requirement.

- 2026 and beyond (planned): Full move to the $600 threshold unless Congress changes the law.

For 2025, the only federal test is whether your reportable payments through a platform total at least $2,500 for the year. If they do, the platform is required to send you and the IRS a Form 1099-K.

2. How We Got Here: From $20,000 To $2,500

The way we got from $20,000 and 200 transactions down to $2,500 and eventually $600 is a mix of legislation, technology, and pushback from the payment industry.

The $600 rule comes from the American Rescue Plan Act of 2021. Lawmakers wanted more visibility into online sales, side hustles, and gig work that previously slipped under the $20,000 threshold. In practice, payment platforms warned that an instant drop to $600 would generate tens of millions of forms, many of them for casual, low value activity or misclassified personal payments.

In response, the IRS announced a phased approach in a series of notices, including IR 2023 221 and Notice 2024 85. The agency delayed full enforcement and introduced the $5,000 threshold for 2024 and the $2,500 threshold for 2025 as stepping stones toward the legal $600 standard.

The upside of this phased rollout is that platforms have more time to clean up their systems and educate users. The downside is that the rules feel like a moving target, which makes it easier for small businesses and casual sellers to misunderstand what they need to report.

3. Who Is Affected By The 2025 Threshold

The 2025 threshold pulls many more people into the 1099-K net. It is not just full time business owners. It reaches almost anyone who uses platforms to collect money for goods or services.

Common examples include:

- Online sellers on eBay, Etsy, Amazon, Poshmark, or Facebook Marketplace.

- Freelancers and gig workers who are paid through PayPal, Cash App, Stripe, or similar processors.

- Rideshare, delivery, and ticket sellers who receive payouts through app based platforms.

- Side hustles and part time businesses that collect payments through card readers or online checkout tools.

Even casual sellers can cross $2,500 in a year if they sell a few high value items or have a busy holiday season. That means they can receive a 1099-K even if they never thought of themselves as a business.

Behind the scenes, these forms are filed by Payment Settlement Entities and third party settlement organizations. Platforms are under pressure to verify seller names and taxpayer identification numbers, so you can expect more requests to confirm your Social Security number or EIN.

4. Federal Versus State 1099-K Thresholds

One of the most confusing parts of 1099-K reporting is that federal and state rules are not always aligned. While the federal threshold is $2,500 for 2025, several states already use a lower threshold, often $600.

States that have adopted low 1099-K thresholds include California, Massachusetts, Vermont, Virginia, and Maine. That means a platform may have to issue a 1099-K for state purposes even when the seller is under the federal $2,500 cut off.

A few practical results:

- You might receive a state 1099-K with no matching federal form.

- Income can be reported to a state tax agency through combined or separate filings from the platform.

- Your total reportable income for federal purposes does not disappear just because no federal form was generated.

If a seller does not provide a valid TIN, platforms must generally begin backup withholding. At the federal level, backup withholding is usually 24 percent of reportable payments. Some states add their own withholding on top, such as an additional 7 percent in California, which can create a real cash flow hit if details are not fixed quickly.

5. Practical Compliance Steps For 2025

The lower threshold will increase reporting and IRS visibility, but it does not change the basic rule: you are required to report all taxable income whether you receive a 1099-K or not. The practical question is how clean and defensible your records look if the IRS or a state agency asks questions.

For 2025, small businesses and sellers should:

- Separate business and personal activity. Use dedicated business accounts and profiles when possible. Avoid mixing personal reimbursements with business sales on the same payment handle.

- Reconcile platform totals. Match your 1099-K amounts to your bookkeeping software, platform statements, and bank deposits. Remember that 1099-K reports gross payments before fees and returns.

- Track adjustments. Document merchant fees, payment processing charges, refunds, chargebacks, shipping costs, and sales tax that are embedded in the gross number.

- Review your tax profile on each platform. Confirm that your legal name, address, and TIN are correct and match IRS records to avoid backup withholding.

- Check state thresholds. If you sell into or from a state with a $600 rule, expect more forms and plan for the state impact as well as the federal one.

- Plan ahead for 2026. If the $600 threshold arrives as scheduled, nearly any regular seller on a platform will receive 1099-K forms. Use 2025 as a trial run to improve your systems.

The upside is that disciplined recordkeeping often reveals missed deductions. The downside is that poor records can make a small side hustle look chaotic on paper, which increases audit and penalty risk.

6. Common 1099-K Filing Errors To Avoid

With more forms going out, more mistakes will show up on tax returns. A few patterns come up over and over when we review 1099-K issues for clients.

- Reporting the full 1099-K amount as profit.

Form 1099-K shows gross payments. If you report that number directly as income on Schedule C without subtracting fees, returns, cost of goods, and other expenses, you will overstate your taxable income and pay more tax than you owe. - Assuming everything on a 1099-K is taxable.

Some payments may be non taxable reimbursements or sales of personal items at a loss. The form is a data point, not a final tax answer. Only net business income and actual gains are taxable. - Ignoring income because no 1099-K arrived.

The IRS expects you to report all business income whether or not the platform issued a form. Relying on the absence of a form is a red flag in an exam. - Misclassifying personal transfers.

If you use a business profile to receive personal gifts or family reimbursements, the platform may treat those as reportable. You will then have to document why certain amounts are not taxable. - Confusing 1099-K with 1099-NEC or 1099-MISC.

It is common to have multiple forms reporting the same revenue streams. Without careful reconciliation, you can double count income.

When a 1099-K looks wrong, the first step is to contact the payment platform, not the IRS. The issuer is the one that must correct and reissue the form.

7. How To Report 1099-K Income Correctly

1099-K forms themselves do not tell you where to put amounts on your tax return. That depends on the nature of the activity and your entity type.

For many individuals:

- Business or side hustle income usually goes on Schedule C if you are a sole proprietor or single member LLC.

- Sales of personal items that produce a gain can go on Form 8949 and Schedule D. Losses on personal use items are generally not deductible.

- Partnerships and corporations report revenue at the entity level and pass through results to owners via K 1s.

The key is to reconcile:

- Start with total gross payments reported on all 1099-Ks.

- Remove amounts that are clearly personal or non taxable reimbursements.

- Subtract documented fees, refunds, cost of goods sold, and other legitimate business expenses.

- Report the resulting net income on the correct schedule for your situation.

Good documentation turns a 1099-K from a stress point into a cross check that supports the numbers on your return.

8. Key Takeaways For 2025 Filings

- The 2025 federal Form 1099-K threshold is $2,500 in aggregate payments, with no transaction count test.

- More small businesses, gig workers, and casual sellers will receive 1099-Ks, and states with $600 thresholds can generate even more forms.

- Only net profit is taxable, but you must reconcile gross reports to your own records to prove it.

- Clean bookkeeping, correct TINs, and early planning reduce the risk of backup withholding, notices, and audits.

- 2025 is a preview of the much lower $600 threshold that is scheduled for 2026 unless the law changes.

If you receive one or more 1099-K forms for 2025 and are not sure how to report them, Nguyen & Associates, CPA can review your platform reports, reconcile income and expenses, and help you build a cleaner structure for future years.

Disclaimer: This article is for general information only and does not replace personalized tax advice. Always consult with a qualified tax professional about your specific situation.