The Alternative Minimum Tax is a parallel tax system designed to make sure high earners pay at least a minimum amount of tax even when they use various deductions and credits. For years, AMT affected fewer taxpayers because of higher exemption amounts. Starting in 2026, recent tax law changes have made AMT a concern again for many high-income households, especially those earning between $750,000 and $1.5 million, because the exemption now disappears much faster as your income rises.

If you live in Colorado or another high-tax state, exercise incentive stock options, hold private activity bonds, or face large income spikes from bonuses or capital gains, you need to understand how AMT works and when it applies to you. The tax doesn’t function like a simple flat rate. Instead, it phases out your exemption as your income climbs, which can push your effective tax rate into the low-to-mid 30% range or higher during the phaseout window.

This article breaks down the income thresholds that trigger AMT exposure, explains how the calculation actually works, and walks through the specific financial moves that can pull you into AMT territory. You’ll also learn about planning strategies that can help you manage or reduce your AMT liability before it becomes a problem.

AMT Exposure Thresholds And Applicability

AMT exposure begins when your alternative minimum taxable income crosses specific dollar amounts that vary by filing status. The exemption shields part of your income, but once you reach certain thresholds the protection phases out and more taxpayers face the parallel tax calculation.

Income Profiles And Filing Status Boundaries

For 2026, the exemption amounts are $90,100 for single filers and $140,200 for married filing jointly. These figures create your initial protection layer.

The phaseout starts at $500,000 of alternative minimum taxable income for single filers and $1,000,000 for joint filers. Each dollar above these levels reduces your exemption by 50 cents under current rules. That rapid erosion means a single filer with $680,000 of AMTI loses the entire exemption because $180,000 excess × 50% = $90,100.

High-income earners typically cross into AMT territory when preference items—state tax deductions, incentive stock option bargain elements, or private-activity bond interest—widen the gap between regular taxable income and AMTI. A joint filer earning $1,200,000 with large state tax deductions may find the $10,000 SALT cap for regular tax creates a huge adjustment that pushes alternative minimum tax above regular tax.

Temporal Relevance Across Tax Years

The 2025 tax year files in 2026 under earlier TCJA-era parameters. Your 2026 tax year—filed in early 2027—will apply the new thresholds and accelerated phaseout rates from the One Big Beautiful Bill Act.

Planning moves in late 2025 directly affect which rules apply. Deferring a large ISO exercise or capital gain from December 2025 into January 2026 shifts the income into the harsher 2026 regime with lower effective exemption space. Conversely, accelerating income into 2025 may preserve more favorable treatment before the tighter phaseout mechanics take effect.

Watch quarterly estimated payment deadlines if projections show AMT liability. Missing required payments triggers penalties even when withholding covers your regular tax.

Core AMT Calculation Mechanics

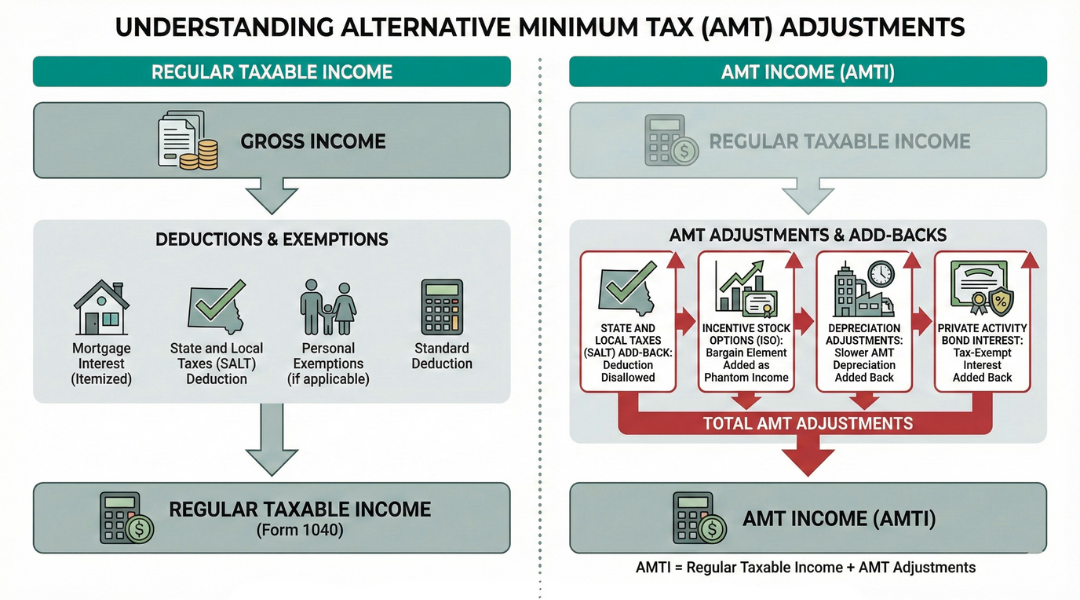

The AMT calculation requires you to compute your tax liability twice—once under regular tax rules and once under AMT rules—and pay the higher amount. This parallel system adds back certain deductions to your regular taxable income and applies a different rate structure with phased exemptions.

Preference Items And Adjustment Categories

Tax preference items and AMT adjustments increase your alternative minimum taxable income (AMTI) by disallowing or limiting deductions that reduce your regular tax liability. The most common adjustment involves state and local tax (SALT) deductions, which are completely added back under AMT rules. This means your full property tax and state income tax payments increase your AMTI dollar-for-dollar.

Incentive stock option (ISO) exercises create a major AMT preference item. The bargain element—the difference between the stock’s fair market value at exercise and your strike price—gets added to your AMTI. This can trigger substantial AMT liability even when you haven’t sold the shares or received cash.

Other key adjustments include certain depreciation differences between regular and AMT methods, private activity bond interest, and miscellaneous itemized deductions. Net operating losses also face stricter limitations under AMT rules. Form 6251 walks through each adjustment category to calculate your tentative minimum tax.

Exemption Phaseouts And Rate Structure

The AMT exemption amount for 2025 is $88,100 for single filers and $137,000 for married couples filing jointly. These exemptions reduce your AMTI before applying AMT tax rates. However, the AMT phaseout begins at $626,350 for singles and $1,252,700 for joint filers, reducing your exemption by 25 cents for every dollar above these thresholds.

AMT rates are simpler than regular tax brackets. You pay 26% on the first $232,600 of AMTI (after exemptions) and 28% on amounts above that threshold. These rates apply to your AMTI minus any remaining exemption amount.

Your tentative AMT is the amount calculated under these rules. You only owe AMT liability when your tentative AMT exceeds your regular tax. The difference becomes your additional AMT payment. High earners often lose their full exemption due to the phaseout, which effectively creates a higher marginal rate during the phaseout range.

Common High-Income AMT Triggers

Several specific tax items push high earners into AMT territory, and understanding these triggers helps you plan more effectively. Equity compensation, state and local tax limitations, and certain investment income create the largest gaps between regular tax and AMT calculations for most households earning above $500,000.

Equity Compensation And Incentive Stock Options

ISOs create one of the most significant AMT triggers when you exercise them. The bargain element, which is the difference between what you pay and the stock’s fair market value at exercise, becomes taxable income for AMT purposes even though it’s not taxed under regular income tax rules.

If you exercise ISOs worth $200,000 but pay only $50,000, that $150,000 spread gets added to your AMT income. This addition happens in the year of exercise, not when you sell the shares.

The AMT hit from exercising ISOs can be particularly severe if you’re already in the exemption phaseout range. A large ISO exercise can push you deeper into phaseout territory or trigger AMT for the first time.

Disqualifying dispositions offer a planning alternative. If you sell ISO shares before meeting the holding period requirements, the bargain element becomes ordinary income for both regular tax and AMT, eliminating the preference item but potentially creating a higher immediate tax bill.

State And Local Tax Deduction Disallowance

Your state and local tax deduction gets completely eliminated under AMT rules. This creates one of the most common preference items for high earners living in states with income tax.

The SALT cap limits your regular tax deduction, but AMT rules are stricter. You get zero deduction for state income taxes, property taxes, or any combination of the two when calculating AMT.

If you pay $50,000 in state income tax and $30,000 in property tax, that entire $80,000 becomes a preference item. High-tax state residents face larger AMT exposure than those in states without income tax, even at identical income levels.

The SALT deduction disallowance compounds other AMT triggers. If you’re already dealing with ISO exercises or other preference items, your state and local taxes can push you firmly into AMT liability.

Depreciation And Private Activity Bond Income

Accelerated depreciation on certain assets creates timing differences between regular tax and AMT. The AMT system requires slower depreciation schedules, which means you report higher income for AMT purposes in early years.

Real estate investors and business owners using bonus depreciation often encounter this trigger. Equipment and property that generates significant first-year deductions under regular tax rules produces smaller deductions for AMT.

Private activity bond interest creates another common trigger for high earners. These municipal bonds produce tax-exempt interest for regular tax purposes, but that same interest becomes fully taxable when calculating your AMT income.

If you hold $500,000 in private activity bonds yielding 4%, that $20,000 of interest gets added to your AMT calculation. Many investors don’t realize their “tax-free” municipal bond income can trigger or worsen AMT liability.

Interpretation From A Colorado CPA Environment

Colorado’s tax structure creates specific AMT planning challenges that differ from other states, particularly for clients earning above $500,000 who face both federal and state minimum tax calculations simultaneously.

High-Earner Profiles Common In Colorado Filings

Tech executives and startup employees holding incentive stock options represent a large portion of Colorado AMT cases. The bargain element from ISO exercises shows up as income under AMT rules but not regular tax, creating substantial phantom income that catches many by surprise.

Remote workers with multi-state income streams also trigger AMT more frequently. Colorado’s 3.47% state AMT rate applies to Colorado alternative minimum taxable income, which mirrors federal calculations but with state-specific modifications.

Real estate investors using accelerated depreciation methods often cross into AMT territory. The difference between regular depreciation and AMT depreciation adds back to income, increasing exposure for those with rental portfolios or commercial property holdings.

State Tax Interactions Influencing AMT Exposure

Colorado’s flat income tax structure intersects with federal AMT in ways that amplify exposure for high earners. The SALT deduction disallowance under federal AMT means Colorado residents cannot deduct state income taxes when calculating their federal AMT liability.

Since Colorado AMT builds from federal alternative minimum taxable income, the compound effect hits harder. You calculate federal AMT first, then apply Colorado’s modifications to determine state AMT exposure.

Municipal bond interest from private activity bonds gets different treatment at each level. While federally taxable under AMT, Colorado may exclude certain bond interest depending on the issuing entity and bond type.

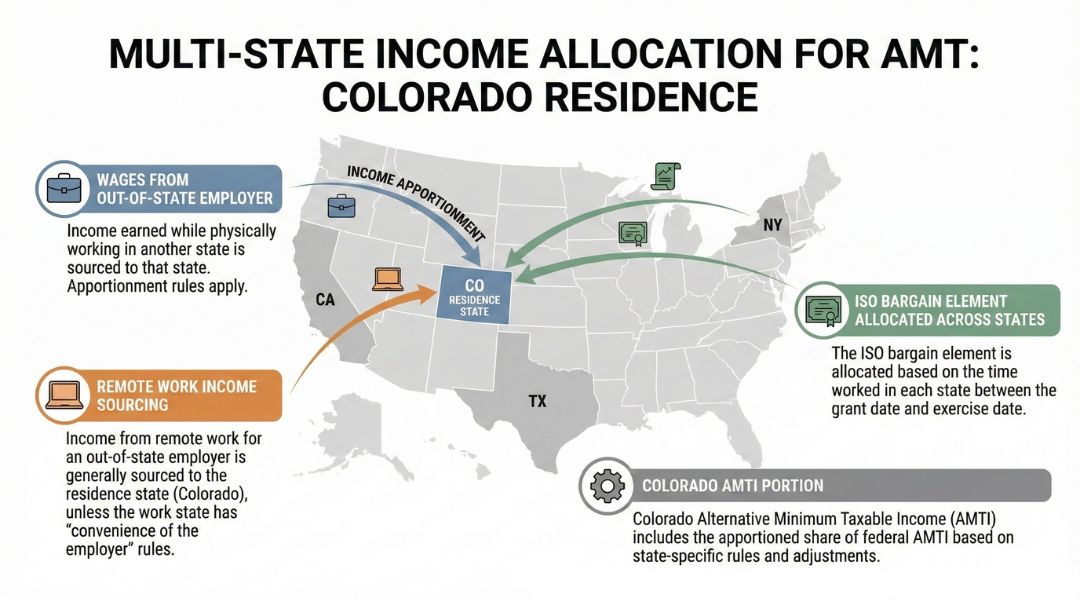

Multi-State Income Allocation Considerations

Colorado requires proper income allocation when you earn in multiple states. Your Colorado alternative minimum taxable income includes only the portion allocated to Colorado using standard apportionment formulas.

Remote work arrangements complicate this allocation. If you live in Colorado but work for an out-of-state employer, the sourcing rules determine which state taxes the income for both regular and AMT purposes.

Stock option exercises require careful state-by-state analysis. The timing of your exercise, your residence state at grant and exercise, and where you performed services all affect which state claims AMT on the bargain element. Colorado follows federal ISO treatment but applies its own apportionment rules for multi-state workers.

Planning Tradeoffs And Consequences

Shifting income or deductions between tax years can reduce your immediate AMT bill, but these moves often create unexpected tax costs down the road or limit your ability to use valuable credits.

Timing Shifts Versus Long-Term Tax Cost

Deferring income to push yourself below the AMT threshold sounds straightforward, but it can backfire. When you delay a bonus or postpone exercising stock options, you might face higher AMT in the following year if your income rises naturally. The same logic applies to accelerating deductions like charitable contributions or retirement contributions into your 401(k). These strategies lower your regular tax but may not touch your AMTI, leaving you with little benefit.

Income timing works best when you expect a drop in earnings the next year. Otherwise, you simply postpone the problem. Tax software can model both scenarios, but many filers skip this step and end up surprised. Accelerating deductions also reduces carryforward benefits if you itemize in future years, so weigh the immediate AMT savings against long-term flexibility.

Credit Utilization And Future Year Implications

Paying AMT generates a minimum tax credit (MTC) that you claim on Form 8801 in years when your regular tax exceeds AMT. This AMT credit recovers some of what you paid, but it only applies to timing differences, not permanent adjustments like state tax add-backs. Many taxpayers overlook this credit or fail to track it across multiple years.

The AMT foreign tax credit also has stricter limits than the regular version, so international income can trigger AMT without full offset. If you minimize AMT this year by shifting income, you might forfeit MTC in future years when your regular tax is lower. Strategic AMT planning means balancing immediate relief with credit preservation, especially if you expect fluctuating income or plan to exercise ISOs over several years.