When you buy equipment for your business in 2025, you face a critical decision that could save you thousands in taxes. Both Section 179 and bonus depreciation allow you to write off equipment costs much faster than traditional depreciation. But they work differently and choosing the wrong one could cost you money.

The best choice depends on your business’s profit level, total equipment spending, and whether you need to create a tax loss, because Section 179 requires taxable income while bonus depreciation has no spending cap and can generate losses to carry forward. Recent tax law changes have made this decision even more important. Bonus depreciation was permanently restored to 100% for property placed in service after January 19, 2025. Section 179 limits jumped to $2.5 million with a $4 million phase-out threshold.

Understanding how these two deductions work together can help you plan equipment purchases with confidence. You may even benefit from using both in the same year. The regulatory environment, operational mechanics, and specific business circumstances all play a role in determining which strategy delivers better results for your situation.

The 2025 Regulatory Landscape And Where Depreciation Rules Apply

Both Section 179 and bonus depreciation apply to specific categories of business assets acquired and placed in service during the tax year. The timing of when property is placed in service—not just purchased—determines which tax year’s rules govern your deduction.

Asset Types And Acquisition Timing That Fall Within Scope

Tangible personal property forms the backbone of both incentives. This includes machinery, equipment, furniture, and most business tools you can touch and move.

Qualified improvement property covers interior improvements to nonresidential buildings. Examples include partition walls, new flooring, upgraded lighting, and remodeled office spaces.

Section 179 also accepts qualified real property improvements such as roofs, HVAC systems, fire protection equipment, alarm systems, and security systems installed after 2017. Bonus depreciation historically has not covered these building components unless they qualify as tangible personal property.

Off-the-shelf computer software qualifies under Section 179 rules. Custom software developed specifically for your business typically does not.

Water utility property qualifies for bonus depreciation but not Section 179. This includes assets like water treatment plants and distribution systems.

Property must be placed in service—meaning ready and available for its intended use—during your tax year. A machine purchased in December but installed in January counts in the later year. Bonus depreciation requires that qualified property also be new to you (original use begins with you) or meet specific used-property requirements for acquisitions after September 27, 2017.

Situations And Entities Intentionally Outside This Discussion

Real estate held for investment does not qualify. Rental properties and land fall outside both incentives.

Property inherited or received as a gift does not meet the “acquired by purchase” requirement. These assets must use regular depreciation schedules.

Property you use less than 50% for business purposes fails the business-use test. Personal use portions receive no immediate expensing benefit.

Assets placed in service in previous tax years cannot retroactively claim 2025 rules. The deduction applies only to the year property enters service.

Listed property—including vehicles over 6,000 pounds GVWR, computers used partly at home, and other assets prone to personal use—face additional recordkeeping requirements and potential limitations. Partnership and S corporation owners should consult their tax advisors because income limitations and basis rules add complexity.

Structural Differences In How Bonus Depreciation And Section 179 Operate

Section 179 and bonus depreciation differ fundamentally in how they interact with your taxable income and what limitations apply to each deduction method. Section 179 expensing requires an election and caps the immediate deduction based on your business income, while bonus depreciation applies automatically to qualifying assets without income restrictions.

Timing Of Deductions And Interaction With Taxable Income

Section 179 cannot create or increase a net operating loss. Your section 179 deduction is limited to your taxable business income for the year, which means you can only deduct up to the amount your business earned.

If your business has little or no profit, section 179 provides minimal benefit. Any unused section 179 deduction carries forward to future tax years.

Bonus depreciation works differently. The additional first-year depreciation deduction has no income limitation and can create or increase a net operating loss. This makes 100% bonus depreciation especially valuable for startups or businesses with low taxable income in their early years.

When you combine section 179 and bonus depreciation, you apply section 179 first up to your income limit. The remaining asset basis then qualifies for bonus depreciation. Any leftover basis after both deductions defaults to MACRS depreciation over the asset’s recovery period.

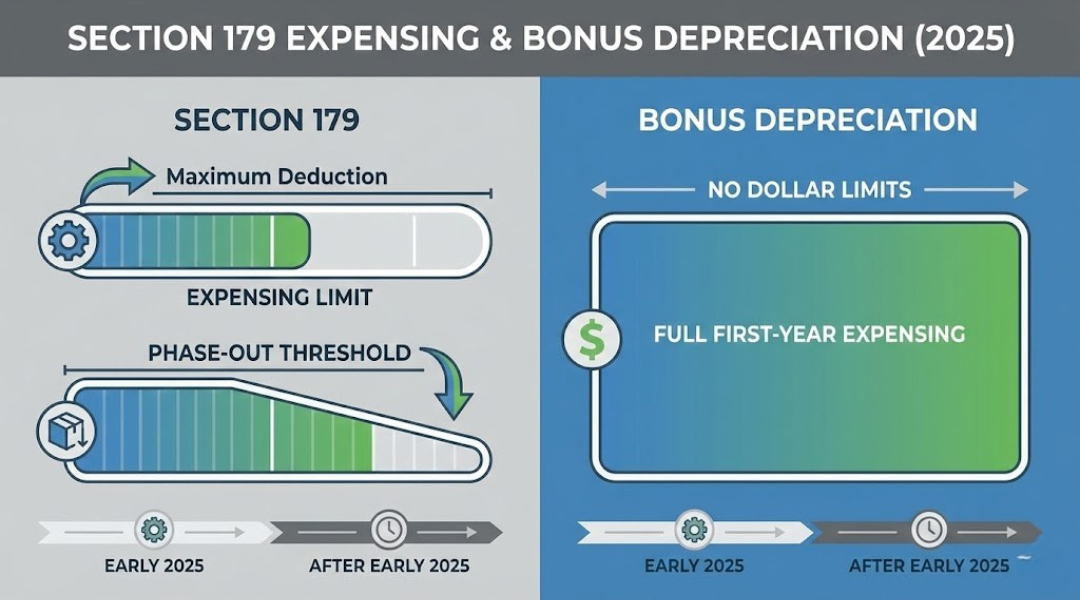

Limits, Thresholds, And Phase-Down Mechanics In 2025

Section 179 has a maximum expensing limit of $1,220,000 for 2025. This limit phases out dollar-for-dollar once your total equipment purchases exceed $3,050,000 during the tax year.

The section 179 election becomes completely unavailable once your asset purchases reach $4,270,000. These thresholds are indexed for inflation starting in 2026.

Bonus depreciation follows different rules. For assets placed in service before January 19, 2025, you can only deduct 40% in the first year under the phase-down schedule. Assets placed in service on or after January 19, 2025, qualify for permanently restored 100% bonus depreciation with no dollar limits or phase-outs.

The bonus depreciation rules apply to both new and used property with a recovery period of 20 years or less. You don’t need to make a section 179 election to claim bonus depreciation—it applies automatically unless you opt out.

Interpreting Tradeoffs, Constraints, And Secondary Effects

Your choice between bonus depreciation and Section 179 creates specific consequences for current and future tax years. Income limits, loss carryovers, and state tax treatment can shift which method saves you more money.

Income Variability, Loss Treatment, And Carryforward Implications

Section 179 cannot exceed your taxable income for the year. If your business generates $80,000 in taxable income, you can only deduct up to $80,000 through Section 179, regardless of equipment cost. Any unused Section 179 amount carries forward to next year.

Bonus depreciation has no taxable income limitation. You can claim the full 40% deduction even if it creates a net operating loss. This net operating loss can offset income from other sources or carry forward to future tax years under current NOL rules.

If your income varies significantly year to year, Section 179’s carryforward feature provides flexibility. You can save unused deductions for profitable years. Bonus depreciation forces the deduction in the year you place assets in service, which might waste deductions if your income is low.

Business use percentage affects both methods. Assets must be used more than 50% for business purposes to qualify for either deduction.

Interaction With State Conformity, Financing Structures, And Future Tax Years

Not all states follow federal bonus depreciation or Section 179 rules. Some states cap Section 179 at $25,000 or completely disallow bonus depreciation. This creates a difference between your federal and state taxable income that requires separate calculations.

Financed equipment complicates your decision. Section 179 lets you deduct the full purchase price immediately, even if you only made a down payment. Your taxable income limitation still applies to the full deduction amount.

Accelerating depreciation lowers your asset basis for future years. If you sell equipment after taking bonus depreciation or Section 179, you’ll recognize more gain because your remaining basis is lower. This depreciation recapture gets taxed as ordinary income, not capital gains.

Reasoning Through Outcomes Across Different Business Profiles

Your choice between Section 179 and bonus depreciation depends on your business size, income level, and growth plans. Companies with different financial profiles need different tax strategies to maximize their equipment deductions.

Capital Intensity, Growth Stage, And Reinvestment Horizons

Startups and early-stage businesses often have lower taxable income in their first few years. Section 179 may not help you much if your business income sits below the equipment cost because the deduction cannot exceed your taxable business income. Your unused Section 179 deduction carries forward, but bonus depreciation might serve you better since it has no income limitation.

Established businesses with consistent profits can use Section 179 up to the $1.16 million cap to reduce taxable income immediately. This works well when you buy a few high-value items. Capital-intensive businesses that purchase millions in equipment need bonus depreciation because Section 179 caps out quickly.

Your growth stage also affects when to use each strategy. Fast-growing companies that reinvest heavily might prefer Section 179 first to maximize current-year deductions against rising income. Mature businesses with stable revenue can layer both strategies based on annual equipment needs.

Short-Term Tax Reduction Versus Longer-Term Depreciation Positioning

Section 179 gives you maximum control over your current tax bill. You choose which assets to expense, letting you fine-tune your taxable income to specific targets. This matters when you want to stay in a lower tax bracket or preserve operating cash flow for immediate needs.

Bonus depreciation at 40% in 2025 spreads your tax benefit across time. You get a smaller deduction now but maintain higher depreciation deductions in future years through regular depreciation schedules. This tax planning approach helps businesses expecting higher tax rates later or those building depreciation reserves for offsetting future income.

Your tax strategy should consider both immediate needs and multi-year projections. Using Section 179 first protects against the taxable income limitation while bonus depreciation acts as a secondary tool for larger purchases.

Frequently Asked Questions

Business owners often need quick answers about deduction limits, vehicle rules, and how to combine both strategies. In 2025, with 100% bonus depreciation restored and Section 179 limits increased to $2,500,000, understanding these details helps you make better tax decisions.

What factors should be considered when choosing between Bonus Depreciation and Section 179 for an equipment purchase in 2025?

Your current taxable income is the first factor to consider. Section 179 cannot create a business loss, while bonus depreciation can generate or increase a net operating loss. If you need to preserve income for other tax purposes, Section 179 gives you more control.

The total amount of your equipment purchases matters too. Section 179 has a $2,500,000 deduction limit and begins phasing out when total purchases exceed $4,000,000. Bonus depreciation has no dollar limit, making it better for large investments.

Your state’s tax treatment plays a role in your decision. Some states do not conform to federal bonus depreciation rules. You may face state tax adjustments that reduce the benefit of bonus depreciation compared to Section 179.

Cash flow needs and future tax rates should guide your choice. If you expect higher tax rates in future years, maximizing deductions now with either method makes sense. You should also consider how the deduction affects your financial statements and loan covenants.

How does the limit on vehicle deductions affect the choice between Section 179 and Bonus Depreciation in 2025?

Vehicle deductions under Section 179 have special limits that depend on the type of vehicle. Heavy SUVs and trucks with a gross vehicle weight rating over 6,000 pounds can qualify for the full Section 179 deduction up to $2,500,000. Lighter vehicles face much lower caps.

For passenger vehicles, Section 179 typically limits your first-year deduction to around $12,200 to $20,200 depending on bonus depreciation availability. Bonus depreciation at 100% can add to this amount, but the combined total still cannot exceed the luxury auto limits. These caps apply even if the vehicle costs much more.

If you buy a vehicle that qualifies for the full Section 179 deduction, using that election first gives you control. You can then apply bonus depreciation to other equipment purchases. This approach helps you maximize deductions across all your assets.

Can small businesses use both Bonus Depreciation and Section 179 in the same tax year for equipment purchases?

Yes, you can use both methods in the same tax year. Most businesses apply Section 179 first to selected assets up to the $2,500,000 limit. After that, bonus depreciation automatically applies to the remaining cost of eligible property unless you elect out.

This layered approach maximizes your first-year deductions. You elect Section 179 on an asset-by-asset basis, giving you control over which items to expense immediately. Bonus depreciation then covers the rest without requiring individual asset elections.

You report both deductions on IRS Form 4562. Part I of Form 4562 covers Section 179, while Part II handles bonus depreciation and regular depreciation. Keeping clear records of which assets receive which treatment helps you complete the form correctly.

What are the maximum deduction limits for Section 179 and Bonus Depreciation in the year 2025?

Section 179 has a maximum deduction of $2,500,000 for 2025. This limit applies to the total amount you can expense under Section 179 across all qualifying assets. The deduction begins to phase out dollar-for-dollar once your total equipment purchases exceed $4,000,000.

Bonus depreciation in 2025 is set at 100% with no overall dollar limit. You can write off the full cost of all eligible assets after applying Section 179. This makes bonus depreciation especially valuable for large capital investments that exceed the Section 179 cap.

Your Section 179 deduction cannot exceed your business taxable income. Any unused Section 179 amount carries forward to future years. Bonus depreciation has no income limitation, which means it can create a net operating loss that you can carry back or forward.

How do the changes in tax law for 2025 impact the decision between taking Bonus Depreciation and Section 179 for new equipment?

The 2025 tax law changes restored bonus depreciation to 100% from the previously scheduled 40% rate. This change makes bonus depreciation more attractive for businesses making large equipment purchases. You can now write off the entire cost of qualifying property in year one through bonus depreciation alone.

Section 179 limits increased to $2,500,000 in 2025, up from $1,220,000 in prior years. The spending cap also rose to $4,000,000 from $3,050,000. These higher limits give you more flexibility to use Section 179 before needing bonus depreciation.

With both methods offering 100% expensing, your decision now depends more on income limitations and strategic tax planning. Section 179 still requires taxable income to support the deduction. Bonus depreciation remains valuable when you want to create losses or when purchases exceed Section 179 limits.

You need to file Form 4562 with your tax return to claim either deduction. The form requires you to list the specific assets and amounts for Section 179 and calculate bonus depreciation separately. The increased limits mean more businesses can fully expense their equipment in the year of purchase.

What are the potential drawbacks of opting for Bonus Depreciation over Section 179 for tax purposes in 2025?

Bonus depreciation applies automatically to all eligible assets in a property class unless you elect out. This all-or-nothing approach gives you less control compared to Section 179. You cannot pick and choose individual assets to receive bonus depreciation within the same property class.

State tax treatment creates complications with bonus depreciation. Many states do not conform to the 100% federal bonus rate or require addback adjustments. Section 179 often has better state conformity, which can reduce your overall tax planning complexity.

Bonus depreciation can create large net operating losses that affect your financial statements. While this may benefit your tax position, it can impact your balance sheet and profit metrics. Lenders and investors may view these accounting losses negatively even though they are non-cash deductions.

You cannot change your bonus depreciation election after filing your tax return without amending. Section 179 elections on Form 4562 also require careful planning, but the asset-by-asset selection gives you more initial flexibility. If you later decide the deduction was too aggressive, correcting bonus depreciation elections becomes more difficult.