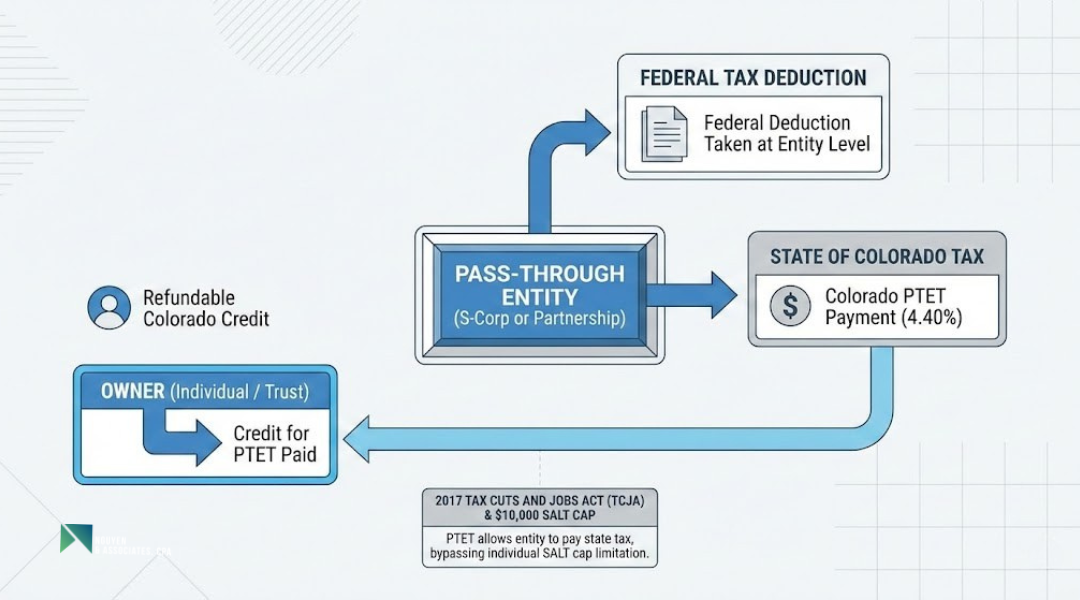

Colorado’s pass-through entity tax can save S-corps and partnerships real money on their federal taxes. The state created this option to help business owners work around the $10,000 cap on federal state and local tax deductions. If your business makes the PTET election, you can deduct state taxes paid at the entity level instead of being limited by the federal SALT cap on your personal return.

The election works by having your business pay Colorado income tax at a 4.55% rate on each owner’s share of income. Your business gets a federal deduction for this payment, and you exclude that same income from your personal Colorado return to avoid double taxation. This approach can lower your overall tax bill compared to paying taxes only at the individual level.

Understanding whether this election makes sense for your situation requires looking at your specific circumstances. This guide walks you through what the Colorado PTET is, how to decide if it benefits your business, the steps to make the election, and how to handle the tax calculations and owner credits correctly.

What Is Colorado’s PTET

Colorado’s Pass-Through Entity Tax (PTET) lets partnerships and S corporations pay state income tax at the business level instead of the owner level. This election helps owners get around the $10,000 federal limit on state and local tax deductions.

How It Works and Why It Exists

The PTET exists as a response to the 2017 Tax Cuts and Jobs Act, which capped individual state and local tax (SALT) deductions at $10,000. When your business pays Colorado income tax at the entity level, you can deduct the full amount on your federal return because it counts as a business expense, not an individual deduction.

Colorado calls this law the SALT Parity Act. The state taxes your pass-through entity at the current corporate income tax rate of 4.40%. Your business pays the tax directly to Colorado instead of passing all income through to your personal return.

You receive a refundable tax credit on your Colorado individual return for your share of the PTET paid. This credit prevents double taxation since the entity already paid tax on that income. The credit also applies to taxes your entity paid to other states.

Colorado stands out as the only state that allows retroactive PTET elections back to 2018. This means you can amend prior years to claim federal deductions you missed.

Who Qualifies: S-Corps and Partnerships

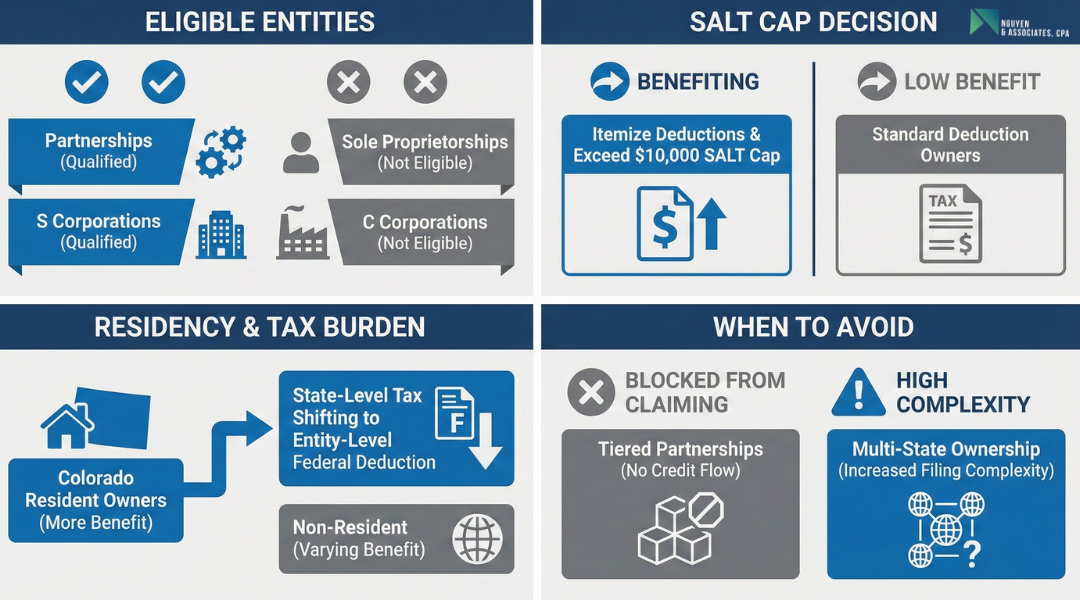

S corporations and partnerships can make the PTET election in Colorado. This includes limited liability companies (LLCs) taxed as partnerships or S corporations.

Your entity must have Colorado-source income to qualify. You don’t need to be based in Colorado, but you must have income connected to the state.

Individual partners and shareholders who are Colorado residents or nonresidents with Colorado income can benefit from the election. C corporations cannot make this election because they already pay entity-level tax.

Trusts and estates that own interests in your pass-through entity also qualify for the tax credit when your entity makes the election.

Key Benefits and Limitations

The Colorado PTET election offers significant tax savings for many business owners, but it doesn’t work equally well in every situation. Understanding both the advantages and potential drawbacks helps you make an informed decision about whether to elect.

Main Advantages for Owners

The primary benefit is avoiding the $10,000 federal SALT cap that limits your individual state tax deductions. When your S-corp or partnership pays Colorado income tax at the entity level, you can deduct the full amount on your federal return.

This creates substantial federal tax savings for owners in higher tax brackets. The entity-level deduction reduces your taxable income before it flows through to your personal return.

Colorado’s unique retroactive feature lets you elect PTET for tax years starting in 2018. You can file retroactive returns for 2018 through 2021, though the IRS hasn’t confirmed whether retroactive payments qualify for federal deductions.

Partners in partnerships can now claim credits for PTET taxes paid to other states. This wasn’t clear before the SALT Parity Act but now applies to both partnership and S-corporation owners.

The tax gets paid at Colorado’s corporate income tax rate, which may be lower than your individual rate depending on your income level.

Situations Where PTET May Not Help

You could end up paying more tax if your home state doesn’t allow a credit for Colorado PTET payments. This creates double taxation where you pay Colorado at the entity level but can’t offset that payment against your resident state tax.

Lower-income owners may not benefit if the entity-level tax rate exceeds their individual rate. The math simply doesn’t work in your favor when you’re already in a lower bracket.

Tiered partnerships face complications. A partner in an upper-tier partnership cannot claim credits for PTET taxes paid by a lower-tier partnership that also made the election.

The compliance costs and complexity can outweigh savings for smaller entities. You need to file additional forms, make estimated payments, and potentially amend multiple years of returns for retroactive elections.

You must model the numbers carefully before electing, especially for retroactive years where the federal deductibility remains uncertain.

Step 1: Decide If PTET Makes Sense for Your Business

The Colorado PTET election works best for certain business structures and owner situations. You need to look at your entity type, owner tax situations, and specific state requirements before making this choice.

Quick Qualification Questions

Your business must be a partnership or S corporation to qualify for Colorado PTET. Sole proprietorships and C corporations cannot make this election.

Check if your owners itemize deductions on their federal returns. If they take the standard deduction, they don’t hit the $10,000 SALT cap anyway. The PTET election provides the most benefit when owners would otherwise exceed this limit.

Look at where your owners live. Owners who live in Colorado and pay high state income taxes get the biggest advantage. The entity pays tax at the state level, which creates a federal business deduction not subject to the SALT cap.

Calculate your expected state tax liability. The election shifts tax payment from the individual level to the entity level. Your owners receive either a credit or exclusion on their personal Colorado returns for their share of the PTET paid.

When to Avoid the Election

Skip the PTET election if your owners already fall below the $10,000 SALT cap. This happens when they take the standard deduction or have minimal state and local taxes.

Tiered partnerships face special limits. If your partnership is a partner in another entity that makes a PTET election, you cannot claim any credit for taxes paid at that lower tier. Colorado rules specifically prevent double benefits in these multi-tier structures.

The election creates complexity for entities with many owners across different states. You need to track additional reporting requirements and handle the entity-level payment process. Small tax savings may not justify the extra administrative work.

Step 2: How to Make the Colorado PTET Election

The election process requires filing specific forms by set deadlines and obtaining proper authorization from entity owners. You must follow Colorado’s timing rules and gather required signatures to complete the election.

Election Timing and Filing Rules

You need to make the Colorado PTET election annually by filing Form DR 0106EP. The election deadline is the 15th day of the fourth month following the close of your tax year. For calendar year entities, this means April 15th.

The election is binding for the tax year once made. You cannot revoke it after the deadline passes.

If your entity expects to owe more than $5,000 in PTET for the year, you must make quarterly estimated tax payments. These payments follow the same schedule as C corporations. The due dates are typically the 15th day of the 4th, 6th, 9th, and 12th months of your tax year.

Colorado allows retroactive elections for tax years 2018 through 2021. The window for these retroactive elections closed on July 1, 2024. You cannot use standard forms DR 1705 or DR 0106 for retroactive elections.

Required Information and Signatures

You must complete Form DR 0106EP with your entity’s basic information. This includes your federal employer identification number, business name, and Colorado account number.

The form requires signatures from authorized representatives. For partnerships, a partner with authority to bind the entity must sign. For S corporations, an officer authorized to sign must complete the form.

You need to identify all partners or shareholders who will be subject to the election. The election binds all owners, so you cannot exclude specific partners or shareholders from the PTET regime.

Keep documentation showing owner consent for the election. While Colorado doesn’t require you to submit owner consent forms with your election, you should maintain these records in case of audit.

Step 3: Calculate Tax and Make Payments

Once you’ve made the PTET election, you need to calculate the tax amount and submit payments to the Colorado Department of Revenue. The entity pays tax on behalf of owners at the corporate income tax rate, and estimated payments may be required depending on your expected tax liability.

How the PTET Tax Is Calculated

The PTET is calculated using Colorado’s corporate income tax rate applied to the pass-through entity’s income. Your entity’s Colorado-source income is multiplied by the current corporate tax rate to determine the total tax owed.

You calculate the tax based on income allocated to all qualifying owners. This includes partners in a partnership or shareholders in an S corporation, except for C corporation partners.

The calculation considers each owner’s distributive share of the entity’s Colorado income. You don’t include income allocated to C corporation partners because they’re not eligible for the PTET benefits.

Your entity reports this tax on the appropriate Colorado return. The tax paid at the entity level creates a credit that flows through to qualifying owners on their individual returns.

Estimated Payments and Common Mistakes

Pass-through entities making the PTET election are not required to make estimated payments under standard rules. However, individual partners or shareholders may need to make estimated payments if their personal Colorado tax liability exceeds $1,000.

Common mistakes to avoid:

- Failing to account for tiered structures where a lower-tier partnership already made a PTET election

- Attempting to claim credits for taxes paid by lower-tier entities

- Missing payment deadlines when voluntary estimated payments are made

- Using incorrect forms or account numbers for payments

If you choose to make estimated payments, use the standard quarterly due dates: April 15, June 15, September 15, and December 15. These payments help avoid potential underpayment penalties at the individual owner level.

Step 4: Report Owner Credits Correctly

After your entity pays the Colorado PTET, each owner receives a credit to avoid double taxation on the same income. Owners must claim this credit properly on their individual Colorado tax returns using specific documentation from the entity.

What Owners Receive

Your S corporation or partnership must provide each owner with detailed information about their share of the PTET paid. The entity needs to report this on the Colorado pass-through entity tax return with sufficient details to identify each owner’s portion.

Each owner receives a credit equal to their share of the tax paid by the entity. This credit amount corresponds to their ownership percentage multiplied by the total PTET paid. The entity must calculate and report these individual credits on the annual return.

You cannot claim this credit unless the entity actually paid the tax and provided the required information. The Colorado Department of Revenue requires specific documentation to substantiate the credit claim.

How Partners and Shareholders Claim the Credit

You claim the credit on your individual Colorado income tax return (Form DR 0104) in the year the entity made the payment. The credit reduces your personal Colorado income tax liability dollar-for-dollar.

You need the information provided by your entity to complete the credit claim. Report the credit amount on the designated line for pass-through entity owner credits. Keep all documentation from the entity with your tax records.

The credit is non-refundable. If your credit exceeds your Colorado tax liability, you cannot receive the excess as a refund or carry it forward to future years.

Simple Example (Short)

A basic walkthrough shows how the Colorado PTET election reduces your total tax burden by converting a non-deductible individual expense into a deductible business expense at the entity level.

1 S-Corp Example Showing Entity Payment + Owner Credit Flow

Your S-Corp earns $100,000 in Colorado taxable income. If you don’t make the PTET election, you report this income on your personal return and pay Colorado tax at 4.40%, which equals $4,400.

With the PTET election, your S-Corp pays the $4,400 tax at the entity level. Your S-Corp deducts this payment as a business expense on its federal return, reducing your federal taxable income to $95,600. You then claim a $4,400 credit on your Colorado personal income tax return for the tax your S-Corp already paid.

The benefit comes from the federal deduction. You avoid the $10,000 SALT cap limit because the payment happens at the business level, not on your personal Schedule A. Your federal tax savings depend on your tax bracket, but the credit on your Colorado return ensures you don’t pay state tax twice on the same income.