Small commercial property owners often overlook cost segregation because they assume it’s only for large-scale investors with multi-million dollar portfolios. Cost segregation studies typically cost between $3,000 and $15,000 but can generate $50,000 to $150,000 or more in accelerated depreciation deductions, often paying for themselves in the first year through immediate tax savings. The challenge is knowing when the numbers work in your favor and when they don’t.

The difference between smart implementation and expensive mistakes comes down to understanding the economics behind the strategy. Not every small commercial property justifies the upfront cost of a formal study. Property value, timing of acquisition, your current tax situation, and the nature of the building itself all determine whether cost segregation makes financial sense or just creates unnecessary complexity.

This article walks you through the specific thresholds where cost segregation delivers measurable ROI for smaller properties, the tax mechanics that drive real results, and the warning signs that indicate you should avoid this strategy entirely. You’ll learn how to evaluate whether cost segregation fits your situation and what pitfalls to watch for before committing to a study.

Where Cost Segregation Meaningfully Applies And Where It Does Not

Cost segregation delivers measurable tax benefits for specific property profiles while offering limited or negative returns for others. Property size, use case, and ownership structure determine whether the engineering analysis justifies its cost.

Property Size, Use, And Ownership Profiles Within Scope

Properties with depreciable basis of $500,000 or more typically generate sufficient accelerated depreciation to justify study costs. Office buildings, retail centers, industrial facilities, and warehouses represent the strongest candidates because they contain identifiable personal property components like specialized lighting, HVAC systems, and interior fixtures.

New construction and property acquisition scenarios deliver the highest returns. When you purchase or build commercial real estate, the entire cost basis is available for component reclassification. Property improvements and tenant buildouts also qualify, particularly when renovation costs exceed $300,000.

Hospitality properties and retail spaces benefit substantially because they contain extensive furnishings, specialized equipment, and unique interior finishes. Commercial property owners who plan to hold assets for five or more years maximize the benefits of cost segregation because they capture the full value of accelerated deductions.

Real estate investors with active business income or rental operations that generate substantial taxable income use cost segregation most effectively. You need taxable income to offset, making this strategy most valuable when your property generates positive cash flow or you have other income sources.

Situations Intentionally Excluded Due To Economics, Compliance, Or Audit Exposure

Properties under $500,000 rarely justify the $5,000 to $15,000 study cost. Raw land, vacant buildings, and properties where land represents over 50% of purchase price lack sufficient depreciable components for meaningful reclassification.

Properties you plan to sell within two years create depreciation recapture complications that often exceed the tax deferral benefits. Short holding periods compress the timeframe for realizing value from accelerated deductions.

Personal-use properties, properties held in IRAs or other tax-deferred accounts, and passive investors with insufficient active income to utilize losses should avoid cost segregation studies. The tax benefits require active participation status or sufficient taxable income to absorb the deductions.

Buildings requiring immediate major renovations create timing complications. You should complete the renovation before initiating the study to capture improvement costs in the analysis. Properties with incomplete or missing construction documentation increase study costs and audit risk because engineers must rely on estimates rather than actual cost data.

The Economic And Tax Mechanics That Drive Cost Segregation Results

Cost segregation works by reclassifying building components into shorter depreciation periods under MACRS, which directly increases your depreciation deductions in early ownership years. When combined with bonus depreciation provisions, this reclassification converts decades of tax benefits into immediate cash flow improvements.

Reclassification Logic And Its Relationship To Depreciation Systems

The Modified Accelerated Cost Recovery System (MACRS) assigns different recovery periods based on asset type and function. Your commercial building structure defaults to 39-year straight-line depreciation, but many components qualify for faster schedules.

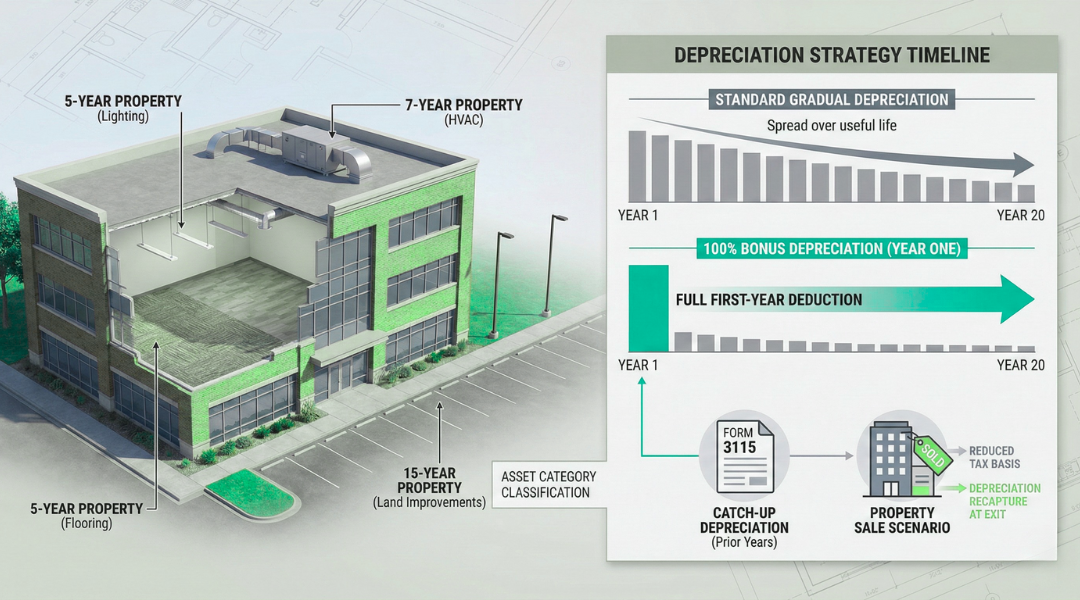

Personal property assets include removable items like carpeting, flooring, window treatments, and built-in appliances. These typically qualify as 5-year property. Land improvements such as parking lots, landscaping, fencing, and exterior lighting fall into 7-year property classifications. Qualified improvements including interior finishes, tenant improvements, HVAC systems, plumbing upgrades, and specialized electrical systems often qualify for 15-year property status.

The reclassification process identifies each component’s actual depreciation schedule rather than lumping everything into the 39-year building category. Your lighting systems, interior walls, and flooring get separated from structural elements like foundations and exterior walls. This cost allocation creates depreciation acceleration by shifting value from longer to shorter depreciation periods.

A proper study documents how much of your purchase price applies to each category. If $200,000 of your $1 million property consists of 5-year and 7-year assets, you can depreciate that portion much faster than the remaining building structure.

Interaction With Bonus Depreciation, Recapture, And Basis Adjustments

Bonus depreciation amplifies cost segregation benefits by allowing immediate expensing of qualifying assets. Under current tax law, you can claim 100% bonus depreciation on personal property assets and land improvements placed in service. This means your 5-year property, 7-year property, and 15-year property can generate first-year depreciation equal to their full allocated value.

Without bonus depreciation, a $100,000 allocation to 5-year property would depreciate over five years. With 100% bonus depreciation, you deduct the entire $100,000 in year one. This creates substantial immediate tax benefits and improved cash flow.

Catch-up depreciation applies when you perform cost segregation on properties you’ve owned for years. Form 3115 lets you claim all missed depreciation deductions from prior years in your current tax return without amending past filings. You don’t lose the benefit of earlier years—you accelerate it into the present.

Depreciation recapture becomes relevant when you sell. The IRS taxes depreciation deductions you claimed at ordinary income rates (up to 25% for real property). Personal property assets face full ordinary income recapture. Your basis adjustments reduce as you claim depreciation deductions, which increases taxable gain at sale. However, the time value of money and immediate tax savings typically outweigh future recapture costs, especially if you hold properties long-term or execute 1031 exchanges.

Evaluating ROI Beyond Accelerated Deductions

Cost segregation analysis delivers value through multiple financial channels beyond immediate tax savings. The true return on investment depends on how long you hold the property, what you do with increased cash flow, and whether the study’s cost matches the complexity of your asset.

Time Value Of Money, Holding Period Assumptions, And Exit Scenarios

Accelerated deductions create immediate cash flow that you can reinvest today rather than waiting decades. A $40,000 tax savings in year one has significantly more purchasing power than the same deduction spread across 39 years. If you deploy that cash toward debt reduction at 6% interest, you save an additional $2,400 annually in interest expense.

Your holding period changes the ROI calculation. If you plan to sell within three years, accelerated depreciation reduces your property’s adjusted basis, which increases capital gains tax liability at exit. For properties you’ll hold 10+ years, this depreciation recapture becomes less significant because the time value of money heavily favors early deductions.

Exit scenario considerations:

- Sale within 5 years: Depreciation recapture (25% federal rate) partially offsets early deductions

- 1031 exchange: Deferred gains eliminate recapture concerns entirely

- Hold until death: Step-up in basis eliminates all depreciation recapture for heirs

- Major renovations: Additional cost segregation opportunities reset the analysis

Calculate your internal rate of return (IRR) by modeling the present value of tax savings against future recapture obligations. Properties generating strong operating cash flow benefit most because you have capital to deploy immediately.

Fee Structures, Engineering Depth, And Diminishing Returns In Smaller Assets

Cost segregation studies for properties under $1 million face economic constraints. A $6,000 engineering analysis on a $750,000 property needs to generate at least $20,000 in accelerated deductions just to break even at a 30% combined tax rate.

Fee structure comparison:

| Property Value | Typical Study Cost | Breakeven Acceleration Needed (30% tax rate) |

|---|---|---|

| $500,000 | $4,000-$6,000 | $13,300-$20,000 |

| $1,000,000 | $5,000-$8,000 | $16,700-$26,700 |

| $2,000,000 | $7,000-$12,000 | $23,300-$40,000 |

Some cost segregation specialists offer abbreviated desktop studies without site inspection for smaller properties. These reports cost $2,000-$4,000 but provide less engineering depth and detail. Your audit risk increases because the IRS expects documented engineering analysis, not desktop estimates based on property type averages.

Properties with minimal tenant improvements, basic construction, or recent acquisitions above market value may not yield sufficient personal property components to justify professional fees. Request a preliminary assessment before commissioning a full study to verify projected returns match your investment criteria.

Interpreting Red Flags, Failure Modes, And Downstream Consequences

Poor cost segregation work creates tax liabilities that compound over years, triggering IRS audits or forcing you to abandon depreciation benefits when you sell. Weak documentation and shortcuts in methodology expose you to depreciation recapture penalties, while misalignment with your broader tax strategy can disrupt 1031 exchanges or limit future planning flexibility.

Documentation Rigor, Audit Defensibility, And Methodological Shortcuts

Your cost segregation study must include detailed asset-by-asset breakdowns with supporting cost data. The IRS expects documentation that traces each reclassified component back to construction invoices, blueprints, or contractor estimates. Firms that skip the Detailed Engineering Cost Estimate Approach often produce reports with vague descriptions like “miscellaneous fixtures” that crumble under IRS audit scrutiny.

Key documentation failures include:

- Missing or incomplete cost estimates for reclassified assets

- No site visits or photographic evidence of property components

- Generic templates that don’t reflect your specific property

- Lack of contractor expertise in pricing construction elements

When the IRS challenges your depreciation deductions, weak documentation forces you to repay claimed deductions plus penalties. Your CPA can’t defend positions that lack proper support. Studies relying on sampling methods or simplified calculations miss assets and create audit risk simultaneously.

Work with your tax advisors to verify the firm uses IRS guidelines and produces reports your CPA can confidently file. The cost segregation audit techniques guide requires substantial proof that your reclassifications match actual asset lives and costs.

Long-Term Tax Positioning, Recapture Risk, And Coordination With Broader Tax Strategy

Depreciation recapture hits when you sell property that benefited from accelerated depreciation. The IRS recaptures the tax benefit at ordinary income rates up to 25% for real property. Poor cost segregation planning amplifies this recapture tax by misclassifying assets or failing to coordinate with your exit strategy.

Your tax planning strategy must account for how cost segregation affects Form 3115 filings for change in accounting method. If you plan a 1031 exchange, accelerated depreciation reduces your basis, potentially limiting tax deferral options. Your tax liability calculation becomes more complex when multiple properties have undergone cost segregation at different times.

Discuss timing with your CPA before starting a study. Properties you’ll sell within three years may not justify the recapture risk. Properties you’ll hold long-term maximize the cash flow benefit from front-loaded deductions. Tax planning requires coordinating cost segregation with entity structure, state taxes, and future acquisition plans to avoid conflicts that increase your overall tax burden.

Frequently Asked Questions

Cost segregation for small commercial properties raises specific questions about profitability, implementation timing, and potential pitfalls. Understanding return expectations, depreciation mechanics, and professional requirements helps property owners make informed decisions about this tax strategy.

What are the potential returns on investment for conducting a cost segregation study on small commercial properties?

Most small commercial properties generate returns between 5:1 and 54:1 on cost segregation study investments. If you spend $5,000 on a study, you might receive $25,000 to $270,000 in tax benefits over the property’s depreciation period.

The study cost ranges from $3,000 to $15,000 depending on your property size and complexity. Smaller properties under $1 million typically cost $3,000 to $6,000 to analyze. More complex properties between $1 million and $3 million often cost $6,000 to $10,000.

Your actual return depends on several factors. Properties with extensive interior improvements typically generate higher returns. Your tax bracket directly affects your savings since depreciation deductions reduce taxable income.

A property worth $1.5 million might identify $300,000 in accelerated depreciation through cost segregation. If you’re in the 37% federal tax bracket, this creates approximately $111,000 in federal tax savings alone.

Most property owners recover their study costs within the first tax year. The combination of accelerated depreciation and current bonus depreciation provisions produces immediate cash flow benefits that exceed the initial investment.

What is the optimal timing for a cost segregation study to maximize tax benefits for commercial real estate?

The best time to conduct a cost segregation study is the same year you purchase or complete construction on your property. This timing allows you to claim maximum depreciation deductions starting with your first tax return.

You can still benefit from cost segregation on properties you’ve owned for years. The IRS allows you to “catch up” on missed depreciation through a change in accounting method using Form 3115. This process lets you claim all the depreciation you should have taken in prior years as a single deduction in the current year.

Properties purchased late in the tax year still qualify for cost segregation benefits. You don’t need to own the property for a full year to claim depreciation deductions.

The current tax environment makes 2026 particularly advantageous. Recent tax legislation maintains favorable bonus depreciation provisions that allow you to deduct 100% of qualifying components in year one.

Renovation or improvement projects also create opportunities for cost segregation analysis. If you invested $500,000 in tenant improvements or building updates, a study can identify which components qualify for accelerated depreciation.

What are common red flags to be aware of when considering cost segregation for commercial properties?

Firms that guarantee specific tax savings amounts before analyzing your property should raise immediate concerns. Legitimate cost segregation providers cannot predict exact savings without conducting detailed engineering analysis.

Companies offering extremely low study fees often cut corners on documentation quality. A $1,500 study might lack the detailed engineering reports needed to defend your deductions during an IRS audit. The IRS expects comprehensive documentation showing how each component was identified and valued.

Desktop-only studies that skip on-site property inspections create audit risk. Engineers need to physically examine your property to accurately identify and classify building components. Remote analysis based solely on blueprints or photographs doesn’t provide sufficient detail.

Providers who promise to reclassify 40% to 50% of your building value into short-life assets may be overstating potential benefits. Most commercial properties realistically show 15% to 30% qualifying for accelerated depreciation.

Be cautious of firms that aren’t willing to provide professional indemnity insurance or audit support. Reputable cost segregation companies stand behind their work and assist you if the IRS questions your depreciation claims.

How does cost segregation influence depreciation schedules for commercial real estate investments?

Cost segregation changes your depreciation schedules by breaking down a single 39-year schedule into multiple shorter schedules. Instead of depreciating your entire building over nearly four decades, you create separate schedules for 5-year, 7-year, 15-year, and 39-year property.

Personal property components like carpeting, fixtures, and removable equipment get assigned to 5-year or 7-year schedules. Land improvements such as parking lots and sidewalks typically fall into 15-year schedules. Only the core building structure remains on the standard 39-year schedule.

This reclassification front-loads your deductions. A property that would generate $25,000 in annual depreciation under standard methods might produce $150,000 or more in year-one deductions after cost segregation.

Your depreciation schedules become more complex after a cost segregation study. You’ll track multiple asset categories separately, each with different recovery periods and depreciation methods. Your tax preparer needs to maintain detailed records for each component category.

The accelerated deductions reduce your building’s tax basis. When you eventually sell the property, you’ll face depreciation recapture on the accelerated amounts. However, the time value of money typically makes the upfront tax savings more valuable than the future recapture costs.

Can a property owner perform a cost segregation study without hiring a professional, and what are the risks?

You can technically perform your own cost segregation study, but doing so creates substantial audit risk and likely reduces your tax benefits. The IRS expects cost segregation studies to include detailed engineering analysis and professional documentation.

DIY cost segregation attempts typically lack the technical expertise needed to maximize depreciation acceleration. Professional engineers understand construction methodology, building codes, and cost estimation techniques that property owners don’t possess. Without this knowledge, you’ll likely miss qualifying components or misclassify assets.

The IRS scrutinizes cost segregation deductions more carefully than standard depreciation. If audited, you need comprehensive documentation showing exactly how you determined each component’s value and classification. Professional studies include hundreds of pages of engineering analysis, photographs, cost calculations, and supporting data.

Self-prepared studies rarely withstand IRS challenges. If the IRS disallows your depreciation deductions, you’ll owe back taxes plus interest and potential penalties. The money you saved by skipping professional fees gets quickly consumed by audit defense costs and tax deficiencies.

Professional cost segregation firms carry errors and omissions insurance. If their analysis contains errors that cost you money during an audit, you have recourse. Your own DIY analysis provides no such protection.

Are there limitations on the number of times cost segregation can be applied to a property?

You can only perform one initial cost segregation study on a property’s original acquisition cost. Once you’ve reclassified building components from the purchase price, you cannot redo that analysis to change the classifications.

However, you can conduct additional cost segregation analyses on new capital improvements made after acquisition. Major renovations, tenant improvements, system upgrades, or building expansions create new depreciable basis that qualifies for separate cost segregation treatment. Each improvement placed in service starts its own depreciation schedule and can be analyzed independently.

For example, if you purchase a property in 2020 and complete a $600,000 renovation in 2026, you may perform a new cost segregation study specifically on the renovation costs. This allows you to accelerate depreciation on the new components without reopening or modifying the original study.

The key limitation is that cost segregation applies to new basis only, not previously analyzed costs. Coordinating improvement timing, study execution, and depreciation elections with your CPA ensures you maximize benefits without creating compliance or recapture issues.