The R&D tax credit isn’t just for Silicon Valley giants. Small businesses across industries can claim this valuable incentive, and many don’t even realize they qualify. If you’ve spent money solving technical problems, improving products, or developing better processes, you may be eligible for significant tax savings.

Qualified small businesses can now offset up to $500,000 per year in R&D credits against payroll taxes, and you can claim credits for up to three prior years if you haven’t already done so. The Protecting Americans from Tax Hikes Act changed the game for startups and small companies with little to no income tax liability. You don’t need a formal research department or scientists in lab coats to qualify.

Understanding how federal and Colorado credits work together matters, especially when Section 174 changes under the One Big Beautiful Bill Act and the proposed Section 174a deduction rules could affect your planning. This guide walks you through the eligibility rules, qualified expenses, how to claim both federal and state credits, and what Colorado CPAs see when clients get it wrong.

Eligibility Boundaries for Small Business R&D

The boundaries for R&D tax credit eligibility center on three key measures: your company’s revenue size, the type of work you perform, and when you generate your first dollar of income.

Business Size and Gross Receipts Thresholds

A qualified small business must meet two financial requirements to claim the payroll tax offset. Your gross receipts cannot exceed $31 million for the current tax year. This threshold increased from $5 million through recent legislation.

Gross receipts include all revenue your business receives. Sales, services, investment income, and any other money flowing into your company counts toward this limit.

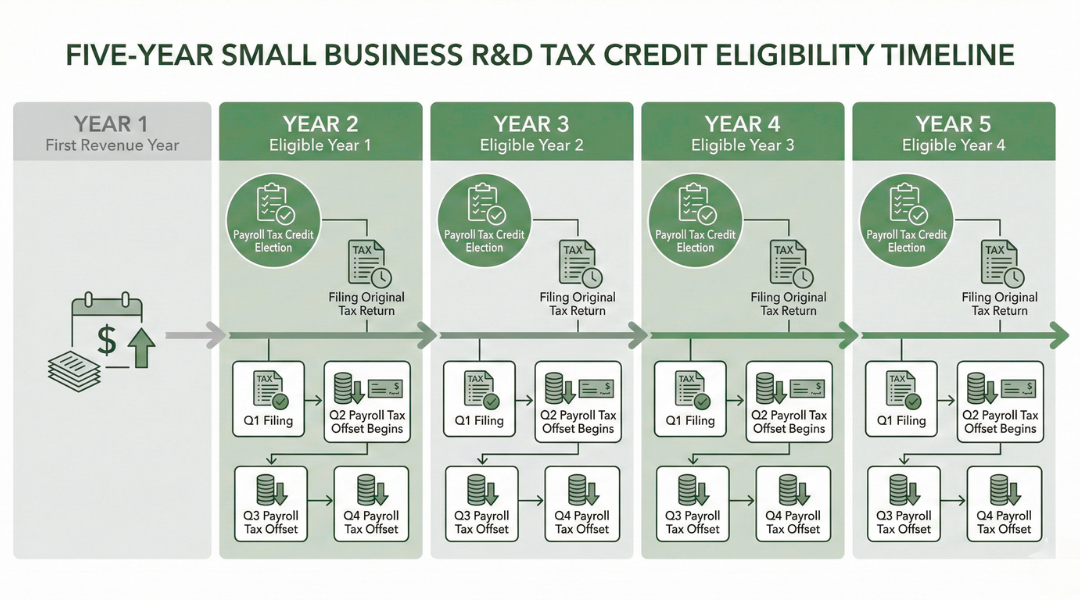

The second requirement involves your revenue history. You must be within five years of your first tax year with any gross receipts. If you started your business in 2020 but earned your first dollar in 2022, your five-year window runs from 2022 through 2026.

Once you pass year five with revenue, you lose qualified small business status permanently. The $31 million threshold becomes irrelevant at that point.

| Requirement | Limit |

|---|---|

| Annual Gross Receipts | Under $31 million |

| Years Since First Revenue | 5 years or less |

| Credit Against Payroll Tax | Up to $500,000 annually |

Industry Scope and Excluded Activities

Research and development tax credits apply across nearly all industries. You don’t need scientists or laboratories. Software development, manufacturing process improvements, and product enhancements frequently qualify.

Your activities must pass the IRS Four-Part Test. The work needs a permitted purpose, technological uncertainty, systematic experimentation, and reliance on hard sciences like engineering or computer science.

Common qualifying activities include developing new products, improving existing product functionality, creating prototypes, and testing manufacturing processes. Writing software to solve technical problems qualifies. Building mobile apps qualifies. Improving production efficiency through engineering changes qualifies.

Activities that don’t qualify include market research, routine quality control, management studies, and cosmetic design changes. Social science research falls outside the scope. Adapting existing products without technical uncertainty doesn’t count.

Timing Relevance Across Tax Years

Your eligibility window starts the first tax year you generate any revenue and extends for five consecutive tax years. Missing even one year means you lose a year of potential tax credits for small businesses that you cannot recover.

You must make the payroll tax election on your original income tax return, including extensions. Filing an amended return later won’t work for adding this election. The credit applies to quarters beginning after you file your return.

If you file your 2025 return in March 2026, you can start reducing payroll taxes in Q2 2026. Credits unused in one quarter automatically carry forward to subsequent quarters within the same tax year.

Qualified Research Activities and Expenditures

The R&D tax credit requires your research activities to meet strict IRS standards and your expenses to fall within specific categories. Understanding the four-part test, eligible cost types, and documentation requirements helps you claim credits accurately while avoiding common compliance issues.

Four-Part Test Conceptual Framework

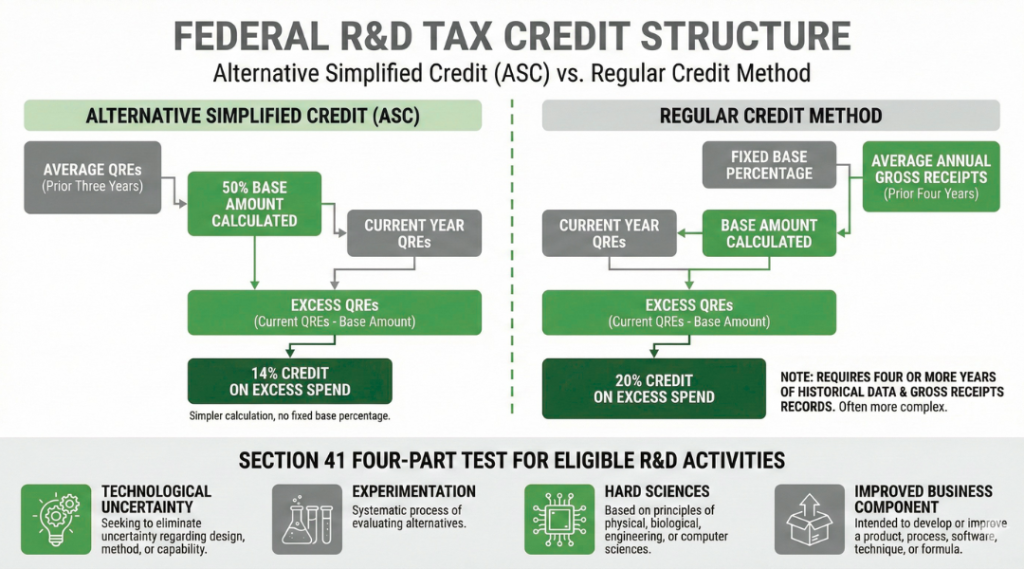

Your research activities must satisfy all four criteria of the four-part test to qualify as qualified research. First, your activities must be technological in nature, relying on principles of engineering, computer science, physical science, or biological science. Second, you must address technological uncertainty about the capability, method, or appropriate design of your business component.

The third requirement is the permitted purpose, which means your research aims to create a new or improved business component in terms of function, performance, reliability, or quality. The process of experimentation forms the fourth criterion, requiring you to evaluate multiple alternatives to eliminate uncertainty through systematic trial and error, modeling, simulation, or other methods.

The business component test determines what you’re improving. A business component can be a product, process, software, technique, formula, or invention you plan to sell, lease, license, or use in your trade or business. Basic research payments for university-conducted scientific research may also qualify under separate rules.

Wages, Supplies, and Contract Research Treatment

Qualified research expenses (QREs) include three main categories of costs directly tied to qualified research activities. Wages paid to employees performing, supervising, or directly supporting qualified research count as QREs. This covers salaries, wages, and stock-based compensation for time spent on qualified activities.

Supply costs used in qualified research qualify, but you cannot include costs for land, depreciable property, or supplies used after commercialization. Contract research expenses receive special treatment. You can claim 65% of amounts paid to third parties for qualified research work. However, payments to related parties, foreign contractors, or for work performed outside the United States face additional restrictions.

Computer rental costs for equipment used in qualified research also count as QREs. Cloud computing costs may qualify under certain circumstances based on recent IRS guidance.

Documentation Standards and Substantiation Limits

The IRS requires contemporaneous documentation that connects your claimed expenses to specific qualified research activities. You need project-level documentation showing how each project satisfies the four-part test, including the technological uncertainty you faced and the process of experimentation you used.

Your documentation should include:

- Project descriptions with technical objectives

- Records of alternatives evaluated

- Test results and design iterations

- Payroll records linking employee time to qualified activities

- Supply invoices with clear research purposes

The IRS updated its guidance in December 2022 to specify required information for valid research credit claims for refund. You must provide sufficient detail to demonstrate each activity’s qualified purpose and substantiate the QRE amounts claimed. Generic descriptions or estimates without supporting records increase audit risk and may result in credit disallowance.

Federal and Colorado Credit Interaction

The federal R&D tax credit under Internal Revenue Code Section 41 provides 6-14% credits on qualified expenses, while Colorado offers an additional 3% through its Enterprise Zone program. Both credits can be claimed simultaneously on overlapping expenses, and the federal Path Act allows qualified small businesses to apply credits against payroll taxes even before turning a profit.

Federal R&D Credit Structure Overview

The federal credit for increasing research activities comes in two calculation methods. The Alternative Simplified Credit (ASC) gives you 14% of your qualified research expenses above 50% of your average spending over the prior three years. The regular credit uses a fixed base percentage of gross receipts but requires at least four years of historical data.

Most small businesses choose the ASC method because it’s simpler and doesn’t require extensive historical records. You calculate your average qualified research expenses from the past three years, cut that number in half to establish your base amount, and claim 14% of anything you spend above that threshold.

Section 41 defines qualified research through four tests. Your work must eliminate uncertainty about capability, method, or design. You must evaluate alternatives through experimentation. The process must rely on hard sciences like engineering, physics, or computer science. Your research must aim to create a new or improved business component.

Colorado State Credit Alignment and Deviations

Colorado follows the federal Section 41 definition for qualified activities but adds a location requirement. Your research must occur inside a designated Enterprise Zone. The state credit equals 3% of increased expenses over your prior two-year average, not the three-year lookback the federal ASC uses.

Key differences:

- Federal credits cover all U.S.-based research; Colorado only credits work in Enterprise Zones

- Federal uses a three-year baseline; Colorado uses two years

- Federal credit applies to total qualified expenses; Colorado only credits the increase

- Federal allows full credit usage in one year; Colorado spreads it over four years

Contract research payments qualify differently at each level. Federal rules let you claim 65% of payments to third-party researchers anywhere in the U.S. Colorado only recognizes contract research if the work happens in Colorado.

Carryforwards, Offsets, and Payroll Tax Elections

The Path Act created a payroll tax offset that lets qualified small businesses apply up to $500,000 of federal R&D credits against their quarterly payroll tax liability. Your business qualifies if you have under $5 million in gross receipts and either no gross receipts before the past five years or gross receipts for fewer than five years total.

You make this election on IRS Form 6765 and claim the qualified small business payroll tax credit on Form 941. This benefit works even when you have zero income tax liability.

Federal credits carry forward 20 years and back one year. Colorado credits only carry forward 12 years with no carryback option. You can’t offset more than 25% of your Colorado tax liability per year, even if you have larger credit balances available.

Credit timing strategy:

- Use federal credits against payroll taxes to preserve cash flow immediately

- Let Colorado credits accumulate and offset future state income tax as profits grow

- Track both carryforward periods separately to avoid losing older credits to expiration

Interpretation From a Colorado CPA Practice

Colorado businesses face specific challenges when documenting R&D credits across state lines and multiple entities, requiring careful attention to evidence standards and practical judgment calls that align with both IRS expectations and business realities.

Multi-Entity and Multi-State Research Attribution

You need to track which legal entity incurs each research expense when your business operates through multiple corporations or LLCs. The IRS requires that only the entity paying the wages or expenses can claim the corresponding credit. If your parent company in Colorado pays researchers who work on projects for a Delaware subsidiary, the credit belongs to the entity issuing the W-2s.

Your multi-state operations create additional complexity when employees work across state lines. You must allocate research hours based on where the work actually occurs, not just where employees live or where your headquarters sits. A software developer working remotely from Denver on a California project may generate qualified research expenses for your Colorado entity, but only if that entity employs them and the work meets federal criteria.

Cost-sharing arrangements between related entities require written agreements before expenses occur. You cannot retroactively decide which entity should claim credits after year-end. Your documentation must show clear service agreements, expense allocation methods, and actual payment flows between entities.

Audit Exposure Patterns and Evidentiary Expectations

You face higher audit risk when claiming credits without contemporaneous documentation of research activities. The IRS expects you to maintain records created during the research period, not summaries prepared when filing your return. Time tracking systems, project notes, and technical specifications created in real time carry more weight than backward-looking reconstructions.

Your documentation should connect specific individuals to qualified activities through timesheets, project assignments, or activity logs. General job descriptions alone do not prove that employees spent time on qualified research. You need evidence showing actual hours devoted to experimentation and technical uncertainty resolution.

Failed experiments and abandoned projects still qualify for the credit if they involved systematic testing. You should preserve documentation of unsuccessful attempts, including test results, design iterations, and technical challenges encountered. This evidence demonstrates the uncertainty elimination process central to qualifying activities.

Practical Boundary Judgments in Applied Compliance

You must decide whether borderline activities qualify for the credit using the four-part test: permitted purpose, technological in nature, elimination of uncertainty, and process of experimentation. Routine data collection and standard industry practices typically fall outside qualified research, even when performed by scientists or engineers.

Your software development work qualifies only when creating new functionality or improving performance beyond standard capabilities. Adding features that competitors already offer or making minor bug fixes does not meet the innovation threshold. You should focus credit claims on novel algorithms, performance optimization requiring testing, or new technical approaches.

Manufacturing improvements qualify when you test new processes or materials to achieve better outcomes than existing methods. Adapting standard equipment to your specific needs through trial and error can qualify. However, quality control testing and efficiency monitoring of established processes do not involve the required technical uncertainty.

Claiming Mechanics, Risks, and Consequences

Filing for the R&D credit requires careful attention to forms, timing, and tax system integration. Each claiming method carries different audit exposure levels and administrative requirements that affect your refund timeline and scrutiny risk.

Original Filings Versus Amended Claims

You file Form 6765 to claim the R&D credit on your original tax return or through an amended return. Original filings processed with your initial tax return face less scrutiny and faster processing times than amended claims. The IRS updated guidance in December 2022 requires amended returns that include R&D credit claims to provide detailed documentation upfront.

When you file an amended claim, you must attach a completed Form 6765 with all required schedules and supporting calculations. The Instructions for Form 6765 specify that you need to include business component identification, qualified research expense categories, and methodology explanations. Vague or insufficient refund claims create procedural risks that can result in immediate rejection without substantive review.

Small businesses filing amended returns should expect 6 to 12 months for processing compared to standard refund timelines. The IRS has increased documentation requirements specifically for refund claims filed separately from original returns.

Interaction With Income Tax and Payroll Systems

The R&D credit operates across multiple tax systems depending on your business structure and profitability. Profitable companies apply the credit against income tax liability using Form 6765. Qualified small businesses can offset up to $500,000 annually against payroll taxes instead.

You claim the payroll tax credit election on Form 6765 and then report it on Form 8974. Form 8974 calculates your credit amount for each quarter. You transfer that amount to Form 941, your quarterly payroll tax return, to reduce your actual payroll tax deposits.

The payroll credit election is annual and applies to all four quarters once made. You cannot split the credit between income tax and payroll tax in the same year. Businesses with both income tax liability and payroll tax obligations must choose which system provides better cash flow timing.

Tradeoffs Between Credit Optimization and Audit Risk

Maximizing your R&D credit claim increases your tax savings but also raises audit probability. The IRS dedicates specialized examination teams to R&D credit claims and maintains industry-specific audit guides for pharmaceuticals, aerospace, and software development.

Aggressive interpretations of qualified research expenses trigger examinations more frequently than conservative approaches. Common audit triggers include high credit-to-revenue ratios, unclear business component definitions, and insufficient contemporaneous documentation. Your documentation quality matters more than claim size in determining audit outcomes.

You can reduce audit risk by maintaining detailed project records, time tracking systems, and technical summaries prepared during research activities. The IRS expects you to substantiate the four-part test for each business component and support all expense allocations with reasonable methodologies.